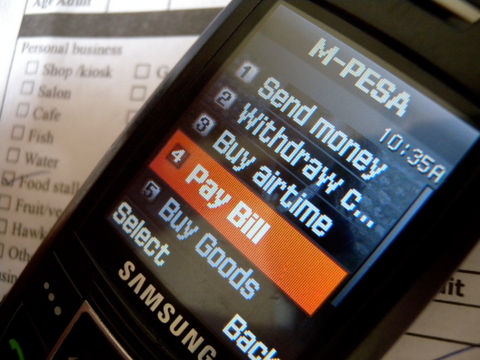

Updated in 2021. – Kenyan M-PESA.

Mobile banking is becoming quite popular in Nigeria, but Kenya seems to be way ahead of us by light years.

Very recently I was in Kenya for a music related gig and for my phone/mobile needs I was advised to register with Airtel Kenya. My mistake. Almost everyone I spoke to or wanted to do a transaction with asked me if I was on M-Pesa. And it was only available on Safaricom, not Airtel. Sigh.

M-Pesa — “pesa” means “money” in Swahili — has made a dramatic impact over this time.

By June 2016, a total of 7 million M-PESA accounts have been opened in Tanzania by Vodacom. The service has been lauded for giving millions of people access to the formal financial system and for reducing crime in otherwise largely cash-based societies. – Wikipedia

Things you can do with M-PESA

- Transfer money easily between your bank and M-PESA

- Enjoy Convenience with the ability to access money from your account any time whether the bank is open or not. This will help you save on time and the cost of travelling to your branch plus the hustle of queuing.

- Since the service is accessed through your mobile phone, it lowers the risk associated with handling cash. You can use the cash withdrawn to pay utility bills, pay for purchases and for money transfer. This makes Bank to M-PESA very convenient in emergency situations.

What’s so cool about M-PESA is that even old people can use it. You can pay an okada man via M-PESA (yes, they have those too) and I don’t mean via bank transfer.

What triggered this post was when I went on a lunch date with a friend at Mama Ashanti, and after the meal, no cash, he just went to his phone, (mind you, it wasn’t a fancy phone) opened M-PESA, clicked on pay bill, inserted the Restaurant’s M-PESA’s number and paid! I was impressed. Note that this wasn’t a bank transfer to an account number. He basically just paid his bill!

The MPESA Interface.

Kenya’s M-PESA is like our normal USSD banking in Nigeria but better because it’s not limited to a bank. It’s also available in more than 10 countries in the world, though South Africa couldn’t keep up with the pressure. I witnessed the power of good banking in Kenya, and I can’t get over it.

Here’s a mini comparison chart between Kenya Mpesa and Nigerian USSD System

| Kenya Mpesa | Nigerian Banks USSD |

|---|---|

| Available in over 10 Countries | Available only in Nigeria. |

| Withdraw money from your Mpesa account from a counter (like a bank) | How???? |

| Transfer money to another person's Mpesa Account | Not Available unless it's the same bank |

| Pay anything with MPESA - House Rent, Buy a Car, ANYTHING | You'll be hanged |

| They just introduced TAP AND PAY. It's a wristband, like in concerts. | No Comment. Sigh |

| If you send money to a wrong MPESA account in error, IT CAN BE REVERSED. | In Nigeria you have to send sms BEGGING the person to send to you. |

| You can withdraw from an ATM. (Without a card.) No Code Necessary. Just Mpesa | When you're not a thief? |

| Good banking | We need to do better. |

FUN FACT: You thought the funds held in M-PESA were held (and used) by Safaricom. The funds are deposited in several commercial banks, which are prudentially regulated in Kenya. In addition, the funds are held by a Trust and are therefore out of reach from Safaricom, which cannot access or use them. In the unfortunate event of Safaricom going bankrupt, the creditors of Safaricom would not have access to the M-PESA funds. This is a requirement from the Central Bank of Kenya which oversees M-PESA. The funds remain at all times the property of M-PESA users. – CGAP

This is such a good innovation.

So glad when I went back in 2019 I promptly registered with Safaricom and joined the M-PESA train. Absolutely love innovation.