What are the methods to receive money from abroad in Nigeria?

Here are several methods that individuals and businesses in Nigeria can use to receive international payments, including:

1. Bank transfer:- Editor’s choice #2

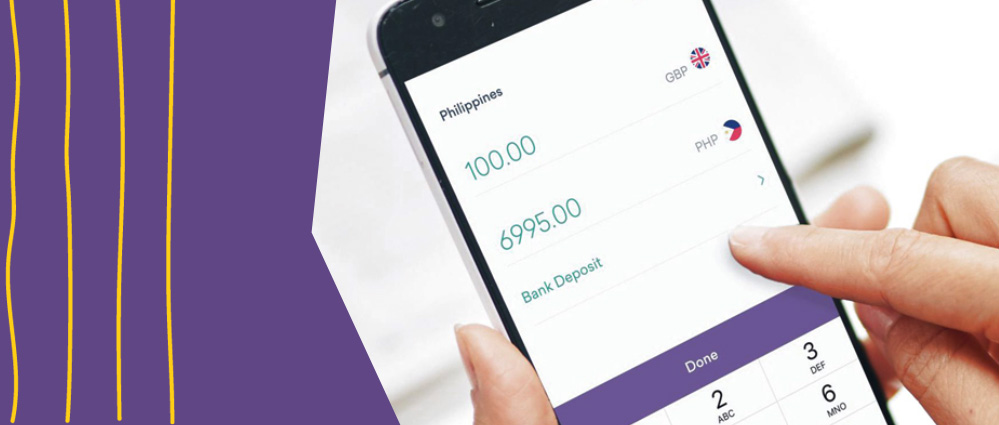

One of the most common methods to receive money from abroad in Nigeria is through a bank transfer. To receive an international payment through a bank transfer in Nigeria, you will need to provide the person or business sending the payment with your bank account details, including your account number and the name of your bank. They can then initiate the transfer through their own bank, and the funds should be transferred to your account within a few days.

Bank deposit is a very secure method. All banks in Nigeria and most international money transfer services use this method to send money around the world. However, bank deposits can often get expensive if the sender uses the SWIFT network to wire the money overseas. Nearly all traditional banks use this network and it is common for them to charge correspondent bank fees for having middlemen banks conduct the transfer.

2. PayPal:

PayPal is a popular online payment service that allows users to send and receive money from abroad. In Nigeria however, you CANNOT RECEIVE MONEY. (I don’t even know why I put it on this list, smh.)

Does PayPal work in Nigeria

Yes, PayPal is available in Nigeria. To use PayPal in Nigeria, you will need to sign up for a PayPal account and link a payment method, such as a bank account or debit card.

‘Yes, PayPal is available in Nigeria. Nigerians can open a personal account to send money, make payments online or shop online. But Nigerians cannot receive money with a personal account. A business account is also available for Nigerian merchants who want to receive payment online.

It’s important to note that PayPal charges fees for most transactions, including receiving payments and sending money to another country. The fees vary depending on the type of transaction and the country you are in, but they can be as high as 3.9% plus a fixed fee for receiving payments. You should be aware of the fees that apply to your account before using PayPal to send or receive payments.

Why can’t Nigerians receive money with PayPal?

“Dear XYZ

I hope you are doing well today. My name is Mark from PayPal Customer Service.

There is currently no work around in giving you the capability to receive payments. The option to receive payments is not available to Nigerian accounts due to our compliance with your local banking regulations. The option to add your Payoneer card to your account is also not available as it will be recognized as a US issued card. In compliance with your local financial regulations, you may only add Nigerian issued cards to your account.

We’ll be glad to hear from you if you need clarification or assistance. Please don’t hesitate to email us again. You can also call us at +1-402-517-4519 (U.S. telephone number) Monday to Friday, 8:00 AM to 4:30 PM local Nigerian time.

Thank you for choosing PayPal. Have a great day!”

This was an actual response from Paypal on a related query. ——— Source

To link a bank to your PayPal account in Nigeria, you will need to log in to your PayPal account and go to the “Wallet” section. From there, you can click on the “Link a bank” button and follow the prompts to add your bank account. You will need to provide your bank account details, including your account number and routing number, as well as some personal information.

It’s important to note that not all banks in Nigeria support PayPal, and you may need to use a different method, such as a money transfer service, to receive payments.

3. Payoneer – Editor’s Choice #1:

Payoneer allows you to receive money from abroad. To receive payments through Payoneer in Nigeria, you will need to sign up for a Payoneer account and provide your account details to the person or business sending the payment. Payoneer will notify you when the payment has been received, and you can withdraw the funds to your linked payment method, such as a bank account or debit card.

The world’s go-to partner for digital commerce. Everywhere.

To sign up for a Payoneer account, you can follow these steps:

- Go to the Payoneer website: Sign up here and get $25 to start!

- Create an account: Follow the prompts to create your Payoneer account, including providing your name, address, and email. You may also need to verify your email address and phone number.

- Verify your identity: Payoneer may ask you to verify your identity before your account can be activated. This may involve providing additional personal information or uploading identification documents.

- Activate your account: Once your account has been approved and your identity has been verified, you will receive an email with instructions on how to activate your account. Follow the instructions to complete the activation process and set up your account.

- Start using your Payoneer account: Once your account is activated, you can start using Payoneer to receive payments. You can share your Payoneer details with the person or business that will be sending you money, and they can initiate the payment using your Payoneer email address or account ID. Payoneer will notify you when the payment has been received, and you can withdraw the funds to your linked payment method.

Once you have linked a payment method and chosen a pricing plan, you can share your Payoneer details with the person or business that will be sending you money. They will need to know your Payoneer email address or account ID, as well as the currency in which you want to receive the payment.

4. Money transfer services:

Western Union and MoneyGram are two of the most well-known money transfer services that are available in Nigeria and allow you to receive money from abroad. However, they are not the only options. There are several other money transfer services that you can use to send and receive money in Nigeria, including:

- Ria: Ria is a money transfer service that allows users to send and receive money internationally. Ria has a wide network of agents in Nigeria, including banks and other financial institutions.

- WorldRemit: WorldRemit is an online money transfer service that allows users to send and receive money to and from over 150 countries, including Nigeria. WorldRemit offers a variety of payment options, including bank transfer, mobile money, and cash pickup.

- Remitly: Remitly is an online money transfer service that allows users to send money to Nigeria and other countries around the world. Remitly offers competitive exchange rates and low fees, and users can choose from several options for receiving the funds, including bank transfers and cash pickups.

To receive a payment through one of these services in Nigeria, you will need to provide the sender with your name and a unique reference number, which they can use to initiate the transfer. You can then pick up the funds at a local agent location by presenting identification and the reference number.

zee